MDF interventions

benefitted

people

stimulated

in Private Sector

Investment

generated

in additional

income

and positively

impacted

women

MDF interventions

benefitted

people

stimulated

in Private Sector

Investment

generated

in additional

income

and positively

impacted

women

Annual Report 2021

Scroll down for highlights and features from the MDF Annual Report 2021

Pro Poor Growth Stories

COVID-19 Recovery Case Studies

Climate Change Focus

Thought Leadership and Systemic Change

Opportunity in a pandemic

At the height of COVID-19, many businesses in Fiji struggled to sustain operations and keep their staff employed. At the same time, the pandemic presented Fiji’s outsourcing services sector with an opportunity for growth. Businesses in nearshore markets, such as Australia and New Zealand, began re-evaluating their global outsource providers. Businesses started looking for providers geographically closer to mitigate future risk and build business resilience. This opportunity was a boon for Fijian households that had lost their source of income, especially those dependent on the tourism industry. With MDF support for outsourcing services expanding between 2020 and 2021, there have been many stories of livelihoods regained. MDF Fiji spoke to Courtney Robinson, a former tourism employee who is now carving out a successful career in outsourcing services.

Digital lending breaks barriers in smallholder agriculture finance

In October 2021, 48-year-old Kesul Setul opened a bank account for the first time. Kesul is from Embor village in the Sumkar area north of Madang Province. Like many Papua New Guineans living in rural communities, Kesul is a subsistence farmer for whom access to essential services is minimal, including banking services. The farmer applied for a small loan of PGK500 (AUD200), enabled by a partnership between MDF, Kamapim Limited, MiBank and Global Systems Mobile Association (GSMA). Through this partnership, MDF supported GSMA to develop a data-driven digital credit product – the first of its kind in PNG.

The silver lining for Sri Lanka’s organic farming industry

Piyarathne is a lead organic farmer in his town of Dambulla, located in the North of Matale District in Sri Lanka’s Central Province. He grows organic moringa, lemongrass, passion fruit and marigold. Piyarathne is one of a small group of farmers in Sri Lanka who have transitioned to certified organic crops. As chemical fertiliser imports were restricted, this choice helped him maintain a stable income in a period of turbulent policy direction that shifted to fully organic agriculture.

The power of processing

The transition from manual to wet mills has increased coffee quality and production in Timor-Leste.Coffee is a critical industry for Timor-Leste. The sector generates USD25 million (AUD35 million) annually, making it the largest non-oil export. Additionally, around 37 per cent of Timor-Leste’s population depend on this sector for at least part of their earnings. For many households, coffee farming is the only opportunity to bring in a cash income. In 2020, due to COVID-19 travel restrictions, MDF secured inbound flights for several key specialty coffee buying personnel who were able to successfully procure the 2020 harvest. This connection immediately boosted coffee cherry prices and established a sales channel for coffee farmers. MDF replicated the activity in 2021, as travel restrictions continued in Timor-Leste due to the pandemic. This venture offered an opportunity for suppliers and farmers to build a direct connection.

Feeding livestock and benefitting households

Improving the quality of fodder that farmers provide to their animals was a key focus area for the MDF Pakistan program. Following the highly successful intervention with Farm Dynamics Pakistan (FDP) between 2017 and 2019, in which MDF supported the partner to introduce 1kg bags of nutritious rye and Rhodes grass fodder to farmers in South Punjab and Gilgit-Baltistan, MDF set out to expand the work through a series of farmer awareness sessions in 2021.

Domestic travellers reinvigorate Fiji’s tourism industry

When COVID-19 froze international travel and caused Fiji’s tourism industry to grind to a halt, it also exposed the sector’s complete lack of information on another key market segment: domestic travellers. This business has now recognised the importance of internal tourism, not only during the pandemic, but also as a potentially viable source of revenue during the international low season. MDF spoke to the popular Intercontinental Fiji Golf Resort and Spa to find out how the Domestic Tourism Demand Study, a market intelligence tool MDF developed in partnership with the Fiji Hotels and Tourism Association and Tourism Fiji, offered foundational support to its marketing plans and package offers.

Pandemic prevention leads to healthier lifestyles

Misak Topi, a coffee farmer from Kofikah in Eastern Highlands Province (EHP) was scared when he first heard about COVID-19 and how fatal it was. When COVID-19 was first detected in PNG in early March 2020, most people in rural PNG were able to sustain themselves in terms of food supply. However, following several COVID-19 outbreaks, most farmers lost their income stream because travel and gathering restrictions made it impossible for them to sell their produce in the town markets. Lockdowns happened twice in EHP, first from March to April 2020 and again from October to November 2021, as PNG battled with a deadly wave of the virus.

Navigating unchartered waters

Pristine coastlines, incredible wildlife and a vibrant culture are some of the unique offerings that keep Sri Lanka at the top of traveller wish-lists. Before COVID-19, tourism was a driving force of economic prosperity and employed close to 200,000 workers directly and some 200,000 workers indirectly in the country. An estimated 80 per cent of industry staff lost work due to the pandemic. Tourism destinations globally recorded one billion fewer international arrivals in 2020 than in 2019; Sri Lanka suffered a similar fate. Nevertheless, tourism remains essential to moving beyond the pandemic.

Supporting market linkages for Timorese tourism operators

“Unprecedented times” was the cliché of 2020, wiggling its way into every company email and news report. In 2021, people shifted to “the new normal” or “weathering the storm.” With no international flight or cruise arrivals in 2021, Timor-Leste’s tourism sector has been on hold since mid-2020. Relying on a trickle of domestic tourists or the occasional business traveler arriving via a charter flight, the sector reported an 80 per cent profit decline. There is no “new normal” for Timor-Leste, but tourism businesses are keen to be ready. Given that the pandemic impact will eventually abate, MDF focused on supporting the tourism industry, especially through information sharing and preparatory work, as businesses set up operations in anticipation of economic recovery. Large-scale initiatives were not pursued due to the uncertainty posed by prolonged travel restrictions and the weak appetite for co-investment in business resources. Instead, the MDF team had discussions concerning partner interests and responded with feasible activities to lay the foundations for future work.

Seeds of resilience

Fiji’s agriculture sector supports over 70,000 farming households and makes up more than 10 percent of the country’s GDP, on average. In an industry highly susceptible to changes in climatic conditions, such as increasing temperatures, changing rainfall patterns and extreme weather events, better access to quality seed varieties is vital to support horticultural and off-season farming. More resilient seeds are a key tool of climate change adaptation for smallholder farmers – who otherwise risk losing their livelihoods.

To address this, MDF has partnered with local company KK’s Hardware to import East-West seeds, an internationally renowned seed brand available in over 60 countries. The seeds have proven to be more climate-resilient than traditional varieties, helping farmers reap harvests and earn income despite adverse weather patterns. They are also high-yielding and off-season friendly.

Brewing climate resilience in the coffee sector

Farmers are highly vulnerable to changes in the climate because they rely on the land and environment for their livelihoods – compounding the challenges faced by smallholders. Papua New Guinea’s rural population are the custodians of their land and still practise traditional farming methods passed down through generations. These practices are built around sustainable land management and environmental protection. However, farming communities have started to notice unpredictable changes in weather patterns, which threaten their traditional gardening practices – ‘gardening’ is a term commonly used for smallholders producing backyard agriculture. The rainy seasons are more erratic, disrupting cropping calendars. Although smallholder farmers are not responsible for the overarching causes of climate change, they are experiencing the negative impacts first-hand.

Making the business case for climate change

In 2021, MDF collaborated with the Ceylon Chamber of Commerce (CCC) to conduct a series of events themed ‘The Business Case for Climate Change Adaptation for Agribusinesses.’ The inaugural webinar of the series, ‘Experience from the Industry Leaders,’ attracted 377 unique participants from 126 businesses, signalling strong interest. This is an excerpt from an interview for the Echelon magazine with MDF Sri Lanka Country Director, Momina Saqib, and CCC CEO, Manjula De Silva. The selection shares MDF’s insights, highlighting the investment case for business, the potential of climate-smart technology and MDF’s growing body of work in this area.

Coffee tree rehabilitation and climate change adaptation

When Cyclone Seroja hit Timor-Leste on 4 April 2021, it devastated the small island nation and coffee farmers were among those affected. With a maximum wind speed of 130 km/h, the cyclone felled the coffee trees in its path, particularly the taller and older ones. A cyclone wreaking havoc in the country is a rare occurrence but likely to become more common, as climate change is expected to exacerbate extreme weather. Coffee is particularly vulnerable to global warming, as coffee trees grow best in cooler temperatures and as global temperatures gradually rise, the areas suitable for coffee farming are expected to decrease by up to 50 per cent by 2050. As Timor-Leste’s top agricultural export, coffee is an important commodity that provides livelihoods for 75,000 households. However, the Timorese crop has some of the lowest yields in the world, at an average 195 kg/ha of green beans, compared with the global average of 2,000 kg/ha. MDF has identified that productivity can be improved by rehabilitation, that is, by stumping and pruning trees. This practice will lead to more, higher quality cherries and shorter trees for easier, selective cherry picking.

De-risking big data

The potential for big data to drive industry transformation is not a new topic, and MDF is increasingly seeing the power of data in effective decision-making in sectors ranging from agriculture to tourism. With the plummeting cost of technology, data-driven business models have matured to a point where they are becoming increasingly feasible at any scale. There are opportunities for data to improve decision-making and drive value chain efficiency. For example, this evidence provides consumer sentiments insights which help inform tourism destination marketing strategies. But adoption at scale is hampered by the large upfront investments in time and capital that are required to embed data into decision-making processes. Working with these knowledge sets is also becoming increasingly complex as its sheer volume increases. Access to this information alone is not sufficient; businesses need to know how to use it effectively. Many of MDF’s partners see the benefits of big data, but the adoption risks are significant.

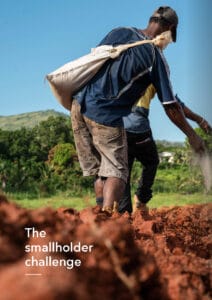

The smallholder challenge

The challenges facing smallholders are well understood. As written in the MDF 2020 Annual Report, these farmers usually lack the capital to invest in productivity enhancing assets, inputs and techniques. This keeps them trapped in a cycle of low productivity and low income. Rather than earning a living wage, their livelihoods are in (near) subsistence. As a result, some of the world’s most indemand products, such as coffee and cocoa, are based on economically precarious supply chains. COVID-19 has made the situation worse, as movement restrictions reduced farmer incomes and further depleted their already meagre asset base. Smallholders are also among the most vulnerable to the impact of climate change disruptions. Changing rainfall patterns, increased prevalence of natural disasters, pests and disease, and higher temperatures threaten crops and subsequently, key commodity supply chains globally. In 2021, MDF explored opportunities for agribusinesses to employ agritech-driven supply chain solutions that improve productivity and, thereby, increase farmer incomes.

Strategic Communication

Throughout the 10 years MDF has worked in the Indo-Pacific, several factors have been vital to its success. Among these is an understanding of the power of high quality communication in achieving program objectives. Traditionally, communication has been seen as a reporting function, churning out annual plans and reports; or as a public relations function, creating good news stories for the consumption of program stakeholders. While both these functions are integral elements of program implementation, MDF’s experience has been that communications can be so much more. In a program like MDF there are multiple strategic outcomes to which our communications team is integral.

Market intelligence

MDF has deeply embedded local teams, with extensive networks and long-term relationships with the private sector. This enables the teams to extract insights on the real-world impacts of the challenges posed by a prolonged pandemic and its associated economic ramifications, as well as climate change and other global shocks. MDF combines bottom-up data collection with an analysis of global macro-observations, generating understanding on how global trends are playing out in the Indo-Pacific. This market intelligence work, initiated in 2020 as a means of filling the information void created by the sudden onset of COVID-19, continued to generate timely and actionable insights for DFAT and partners in 2021. MDF developed a facility-wide intelligence brief each quarter. Two key pieces of work were later published for wider circulation. The first revealed the impact of COVID-19 on the freight industry and the ramifications for importers and exporters in Pacific Island Countries. The second analysed how food price inflation was impacting households in MDF countries. Both pieces of intelligence were written long before these issues became front page news, underlining the value of reliable local networks to provide early warning on emerging economic challenges.

Fiji Outsourcing Services

The outsourcing services sector holds immense economic promise for Fiji but has operated for many years without reaching its potential. To correct this gap, in 2017, the Business Process Outsourcing Council (BPOC) of Fiji was established by several key stakeholders with an initial grant from the Fiji Government. At the time, Outsourcing Services providers promoted their own businesses in overseas markets and primarily relied on the owners’ personal networks and word of mouth to secure new clients.

Silage in Pakistan

Pakistan has the seventh-largest livestock population in the world. However, the dairy and meat sector has yet to achieve its full potential. Domestic demand for milk outstrips supply, presenting an opportunity for smallholder farmers to increase their incomes by supplying more milk to formal markets. Livestock rearing regions tend to be remote, with limited access to inputs and markets. MDF’s analysis found that the principal challenges preventing farmers from selling more milk and meat were low yields resulting from the fact that local agriculturalists were not aware of animal husbandry best practices and they did not have access to affordable, nutritious fodder. MDF focused on increasing smallholder and landless farmers’ access to nutritious fodder, which was a particularly acute problem during the dry season. Smallholders allocate part of their land to growing green fodder, which provides sufficient animal feed for four to seven months. Landless farmers might be allowed to cut green fodder from other farms on which they laboured. For the remainder of the year, farmers had to rely on less nutritious fodder, such as rice and wheat straw, cottonseed cake and leftover bread, to feed their animals. Nutritional deficiencies and low yields were the inevitable outcomes.

Triggering a shift in PNG’s coffee market

MDF’s strategy is to facilitate a shift in the PNG coffee market from commodity grade to high grade and certified coffee. For this to happen, critical market functions like extension, finance, transportation and certification have needed to be established and expanded. MDF’s foundational work in this market system was in supporting extension services. Since 2018, MDF has worked with coffee exporters to build the capacity of their extension teams, who in turn train smallholder farmers on: international market requirements, certification standards, cultivation practices, and processing techniques. Better information has enabled smallholders to raise quality and comply with certification requirements, enabling them access to premium markets and higher prices.

Developing resilience and sustainability in Sri Lanka’s Blue Swimming Crab system

The Blue Swimmer Crab (BSC) sector in Sri Lanka is showing signs of systemic change, having transformed from a locally caught and consumed seafood to a certified export commodity in the last decade. MDF has documented this collaborative success in a 2018 case study. More recently, MDF increased the resilience of the market system by enabling government departments to actively participate in responsible wild BSC stock management. The move ensures the sector’s ongoing sustainability. A well-managed fishery (the only one of its kind on the island) has emerged from what began as an effort to stimulate market linkages and employment in the northern BSC sector. In 2021, MDF organised a training and workshop series for Fishery Officers as part of the Fishery Improvement Project (FIP) in the northern districts of Mannar, Kilinochchi and Jaffna. The trained Fishery Officers are now helping communities understand the importance of adopting sustainable practices for the long-term resilience of their incomes.

Changing Timor-Leste’s pig market system

Pigs are vitally important to Timorese farmers – 80 per cent of households own pigs. They are a source of savings, income, and food. Pigs are also used in cultural ceremonies. The arrival of African Swine Fever (ASF) threatened all of this. (ASF is a highly contagious pig disease first detected in Timor-Leste in September 2019 that has since killed close to 25 per cent of the national herd. The fatality rate is high and there is no treatment or vaccine currently available. Building awareness among pig farmers about the disease, its potential impact and prevention is vital. In early 2020, in partnership with the Timorese Ministry of Agriculture and Fisheries (MAF), MDF supported the design of a communications campaign for this purpose. Utilising high quality reading material and video content, the innovative campaign was launched nationwide in July 2020. The objective was to build awareness about ASF and encourage improved biosecurity practices to reduce pig deaths. The intervention was highly effective in changing farmer behaviour, with MDF estimating that over 200,000 farmers received information from the ASF campaign through various channels, which improved the capacity of 64,000 farming adults to prevent disease in livestock.

Cashing in on Pacific remittances

The Pacific is one of the most remittance-dependent regions in the world. Pacific Island Countries (PICs) have a large diaspora, particularly in Australia and New Zealand. Just under 130,000 Samoans live overseas, compared to a domestic population of around 200,000. Remittances are an outsized component of many families’ incomes and an important source of foreign exchange. In Tonga, they make up 43 per cent of GDP and in Samoa, 21 per cent. Samoa recorded remittances reaching SAT164.4 million (AUD87.1 million) in Q3 2021, up 18.4 per cent compared to the same quarter in pre-COVID 2019. In both countries, around 80 per cent of households received remittances. With a growing number of Pacific Islanders participating in labour mobility schemes, and with other sources of foreign exchange, such as tourism, limited due to the pandemic, capitalising on remittance flows is essential for economic growth in the Pacific.