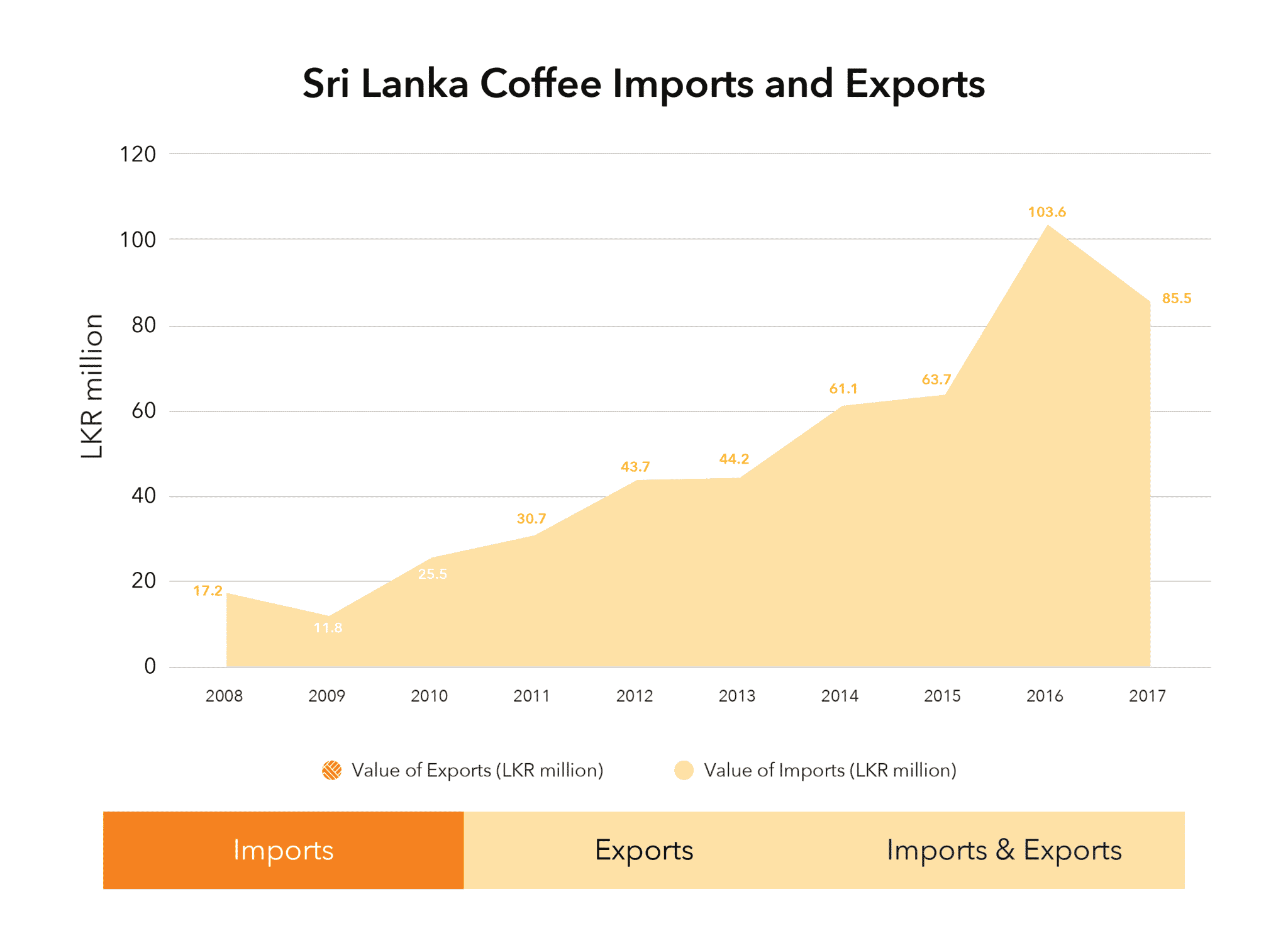

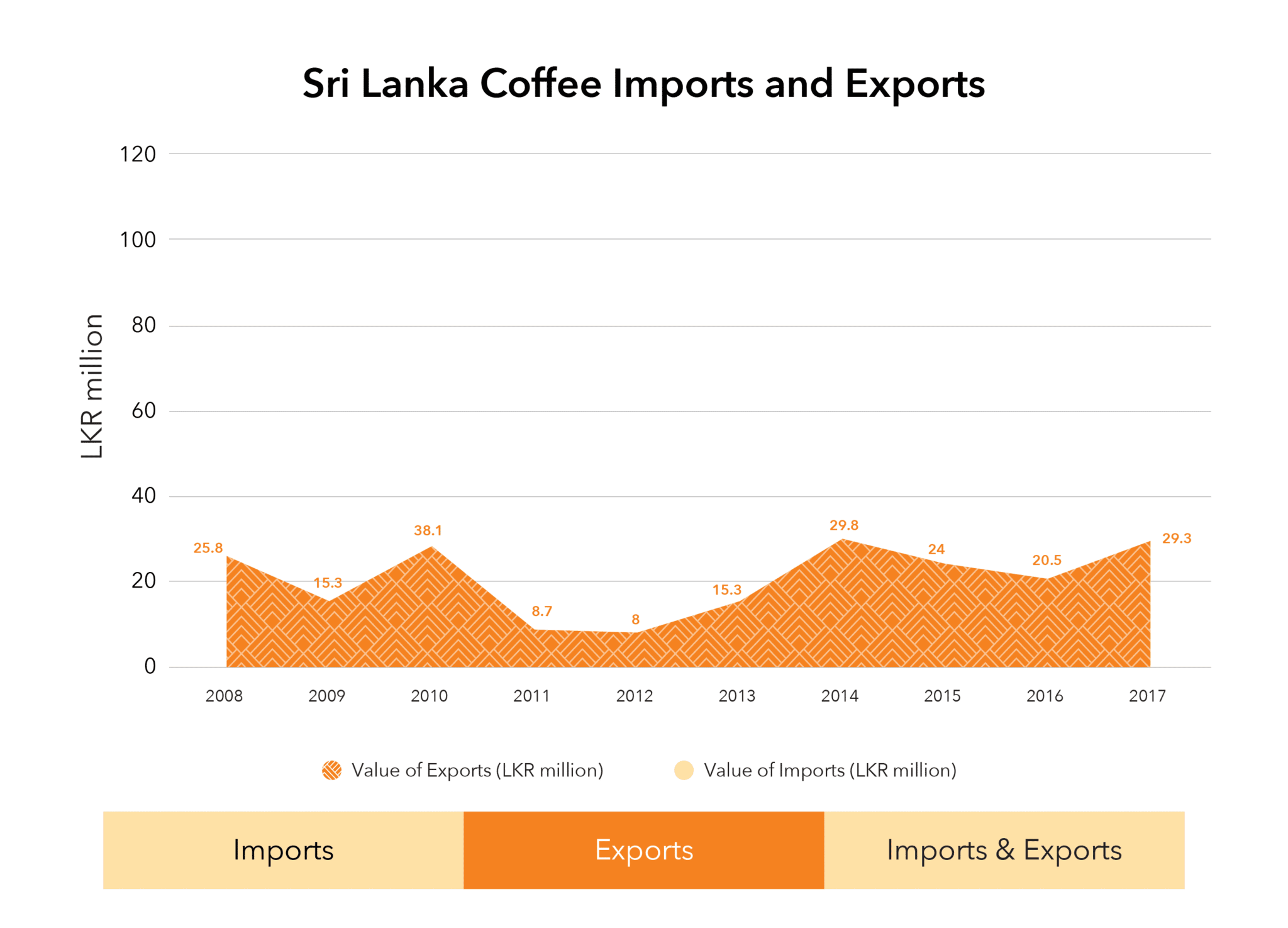

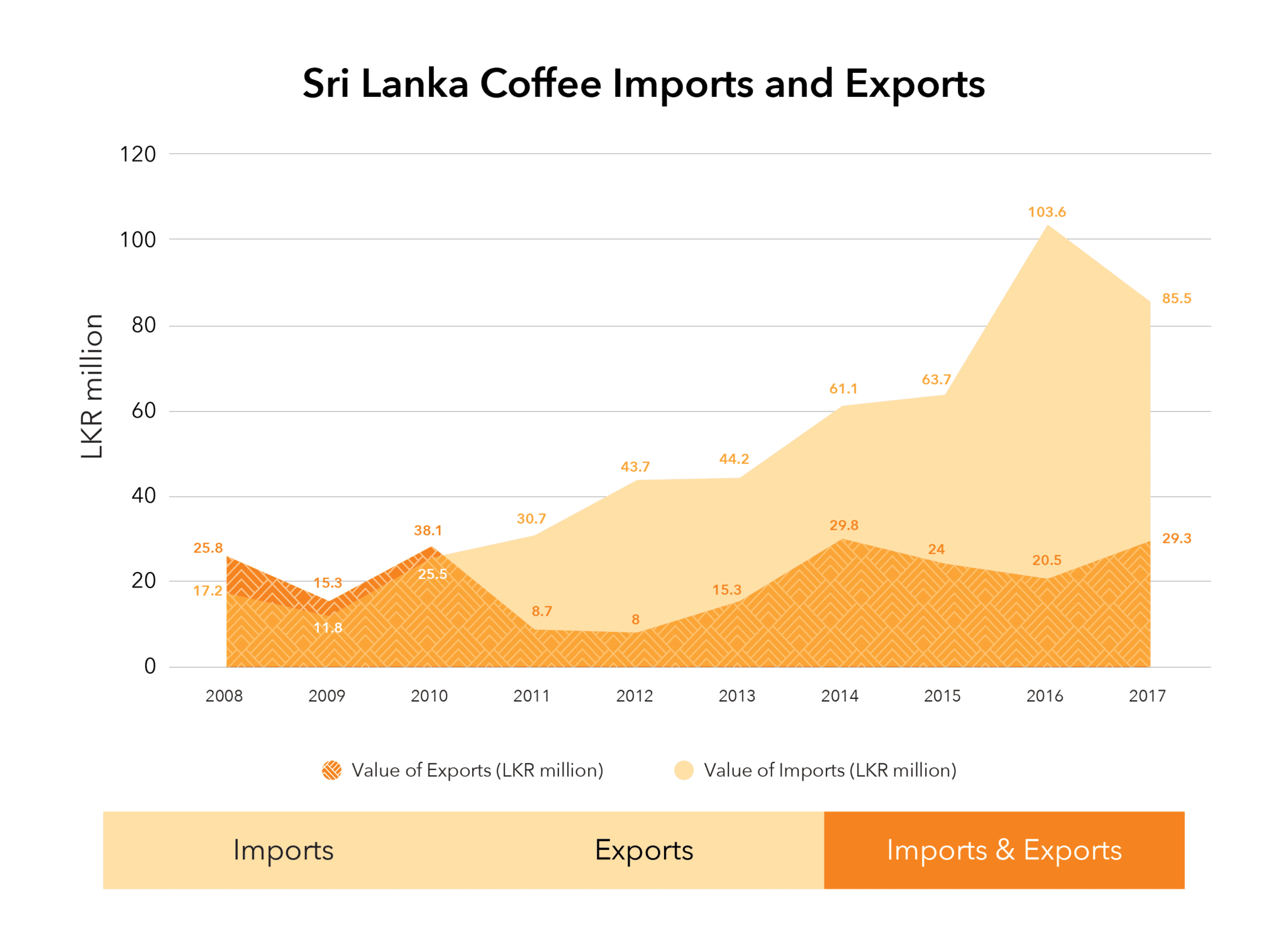

In the 1800s, Sri Lanka was the world’s third-largest exporter of coffee, recording an export volume of 2 million pounds of green beans.

But the Coffee Leaf Rust disease devastated the country’s plantations in the 1860s.

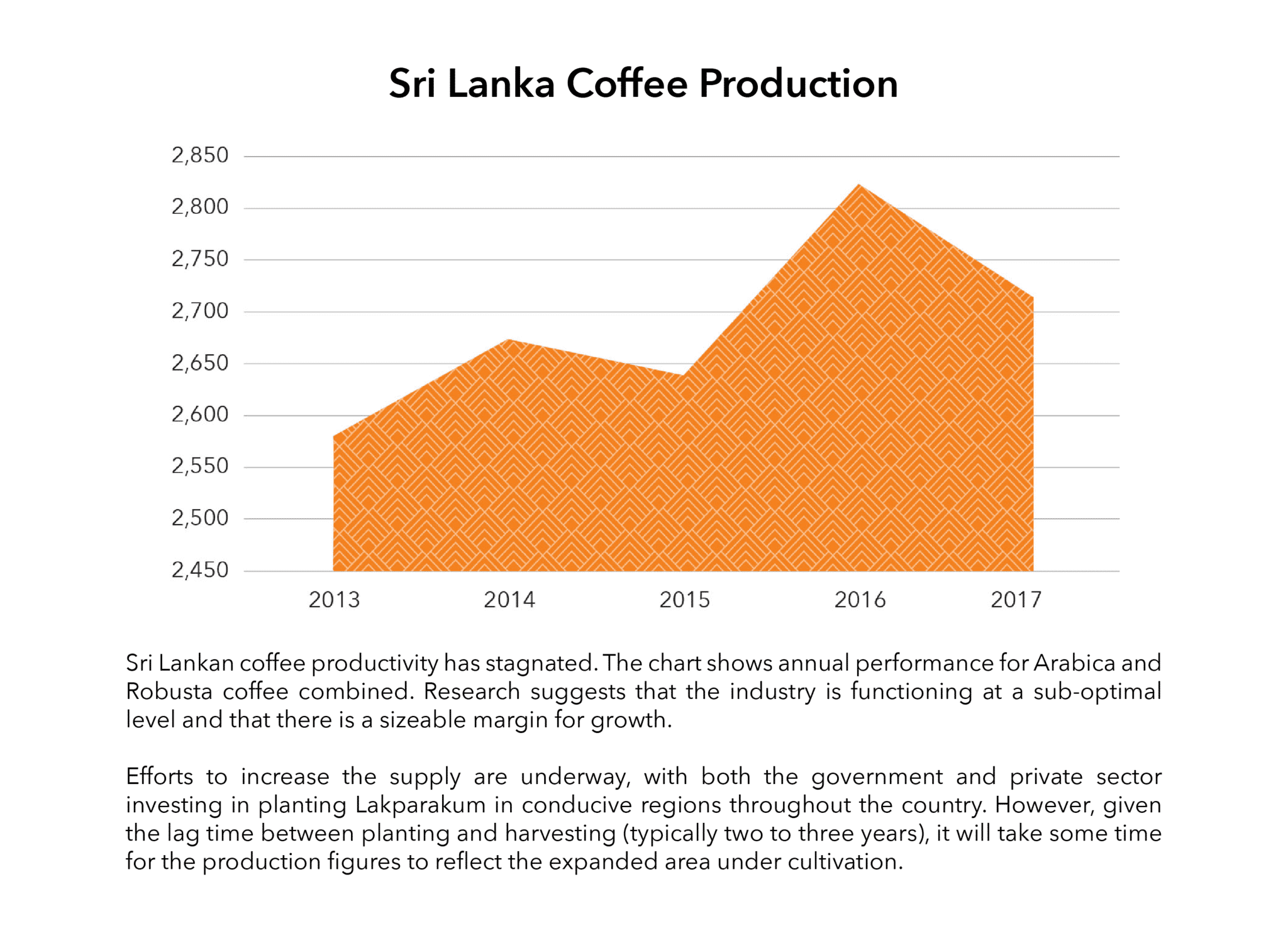

The Sri Lankan coffee industry never recovered. Exports have remained low ever since.

Coffee is now making a gradual comeback. Investments across the supply chain from the government and the private sector have driven up demand.

As global demand for specialty coffee continues to rise, the time is ripe for authentic Ceylon Coffee to make its mark in local and international markets.

Market Development Facility (MDF) Arabica Coffee Value Chain Analysis is a one-of-a-kind, in-depth analysis into the specialty arabica coffee sector in Sri Lanka. The study collects information from bean to cup, charting the pathways to scale and identifying the opportunities for growth in the arabica coffee sub-sector in Sri Lanka. The recommendations of the report can be used by all stakeholders to align their efforts to achieve sustainable growth in this niche industry.

Market Development Facility (MDF) Arabica Coffee Value Chain Analysis is a one-of-a-kind, in-depth analysis into the specialty arabica coffee sector in Sri Lanka.

The study collects information from bean to cup, charting the pathways to scale and identifying the opportunities for growth in the arabica coffee sub-sector in Sri Lanka.

The recommendations of the report can be used by all stakeholders to align their efforts to achieve sustainable growth in this niche industry.

Global

Demand for

Specialty

Coffee

Market expected to grow over

USD 80 billion by 2025

Market revenue is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.3%

Market volume is projected to grow at a CAGR of 8.3%

Global Demand for Specialty Coffee

Market expected to grow over USD 80 billion by 2025

Market revenue is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.3%

Market volume is projected to grow at a CAGR of 8.3%

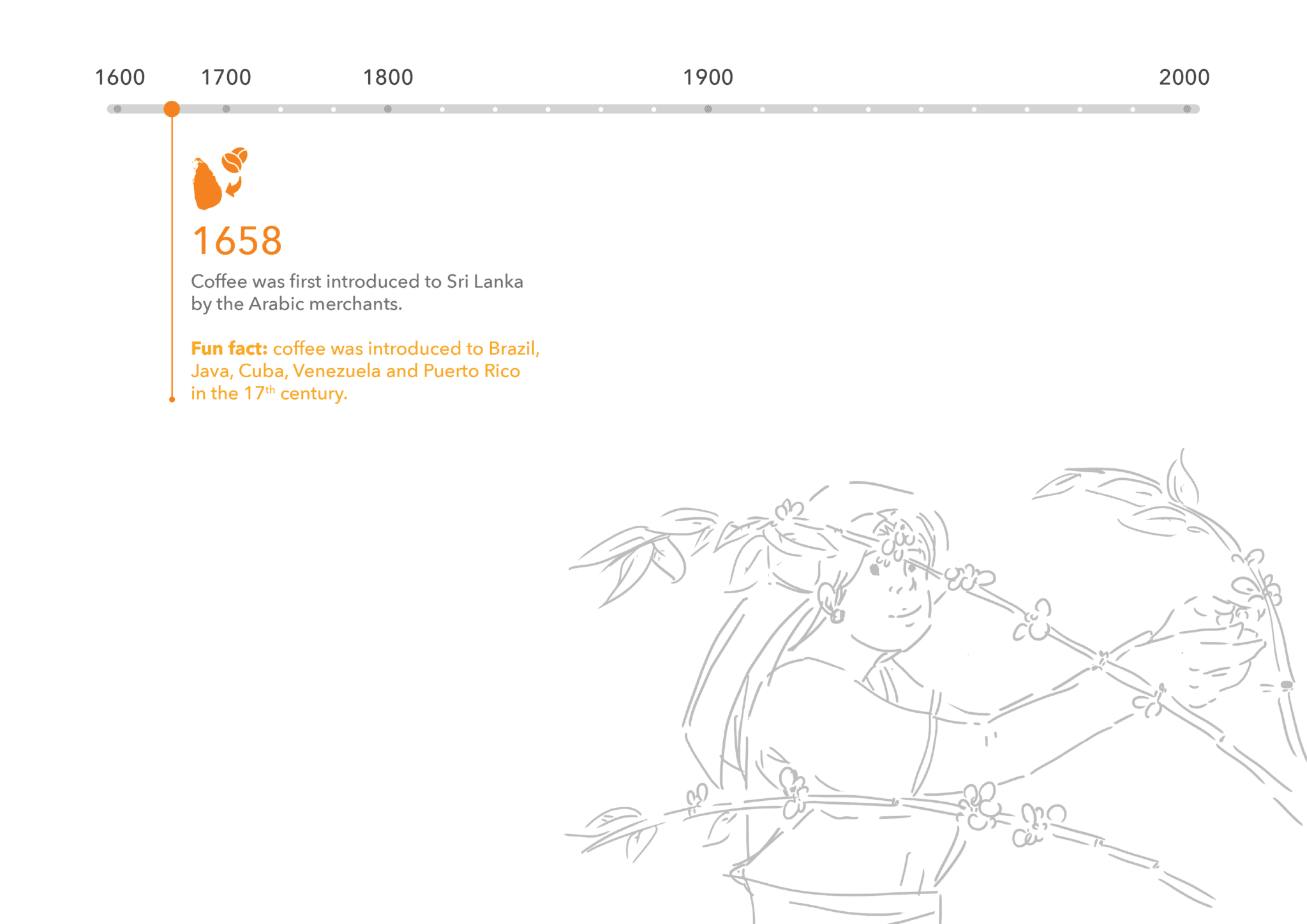

Evolution of Sri Lankan Coffee

Sri Lanka's potential

to meet the

global demand for

Specialty Coffee

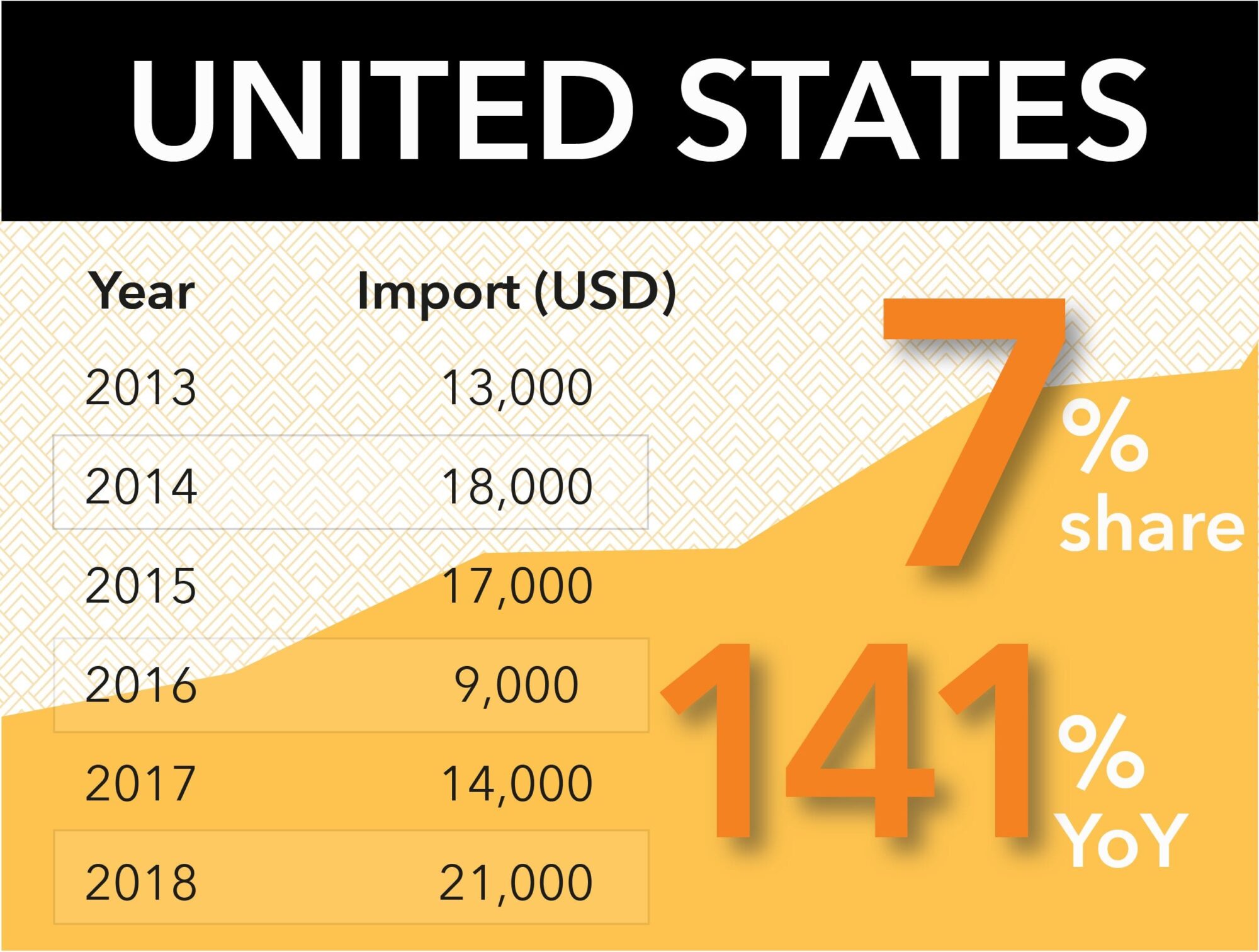

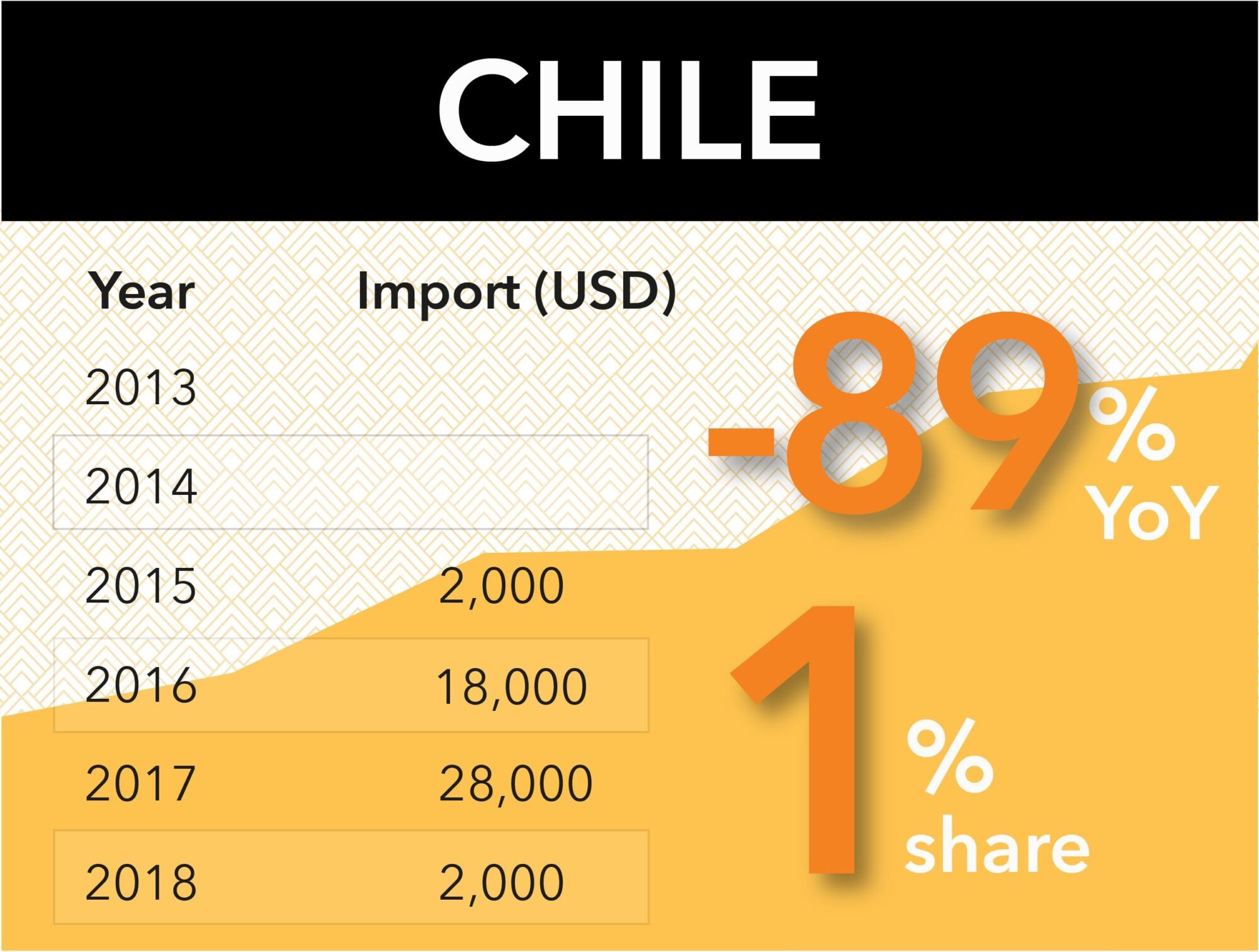

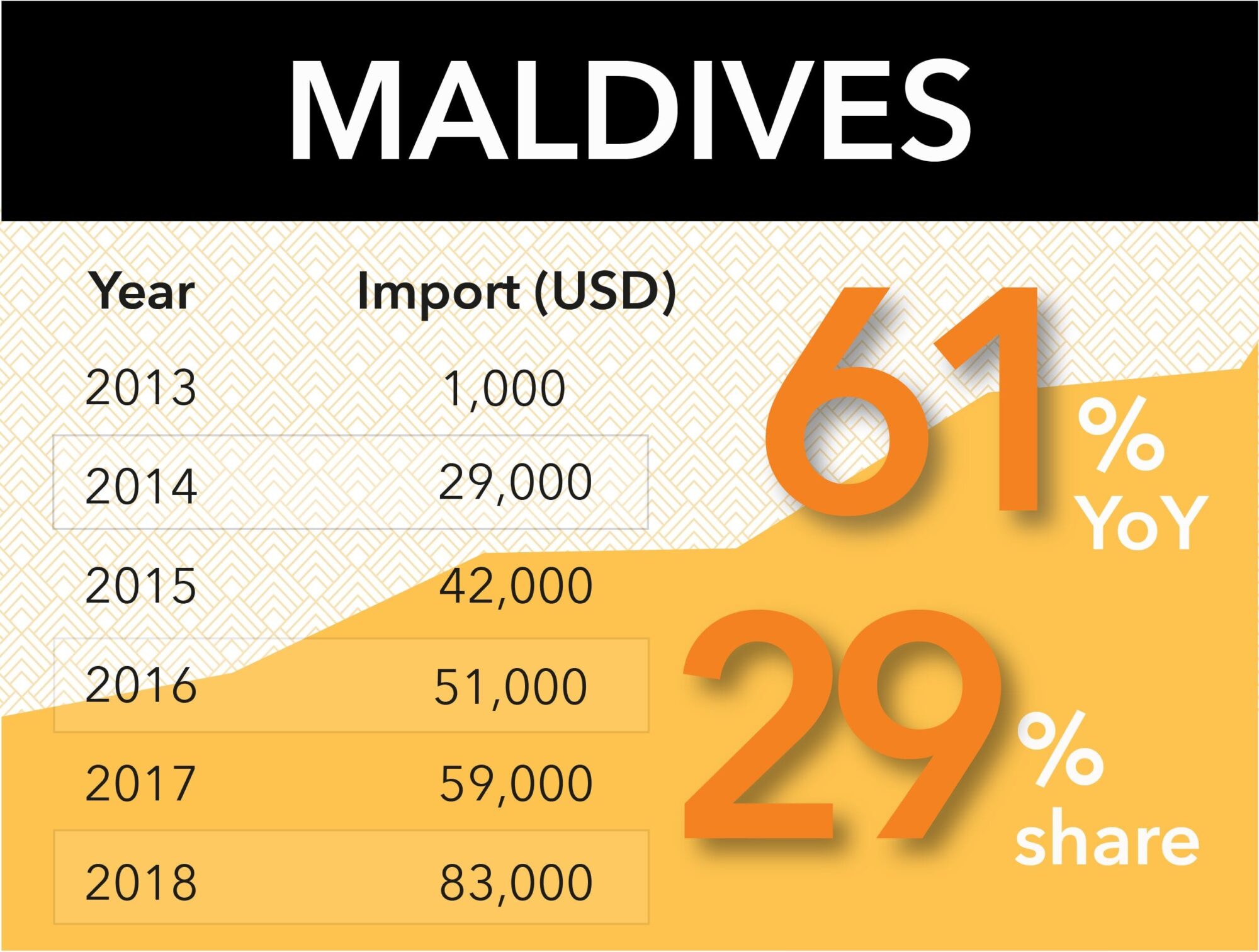

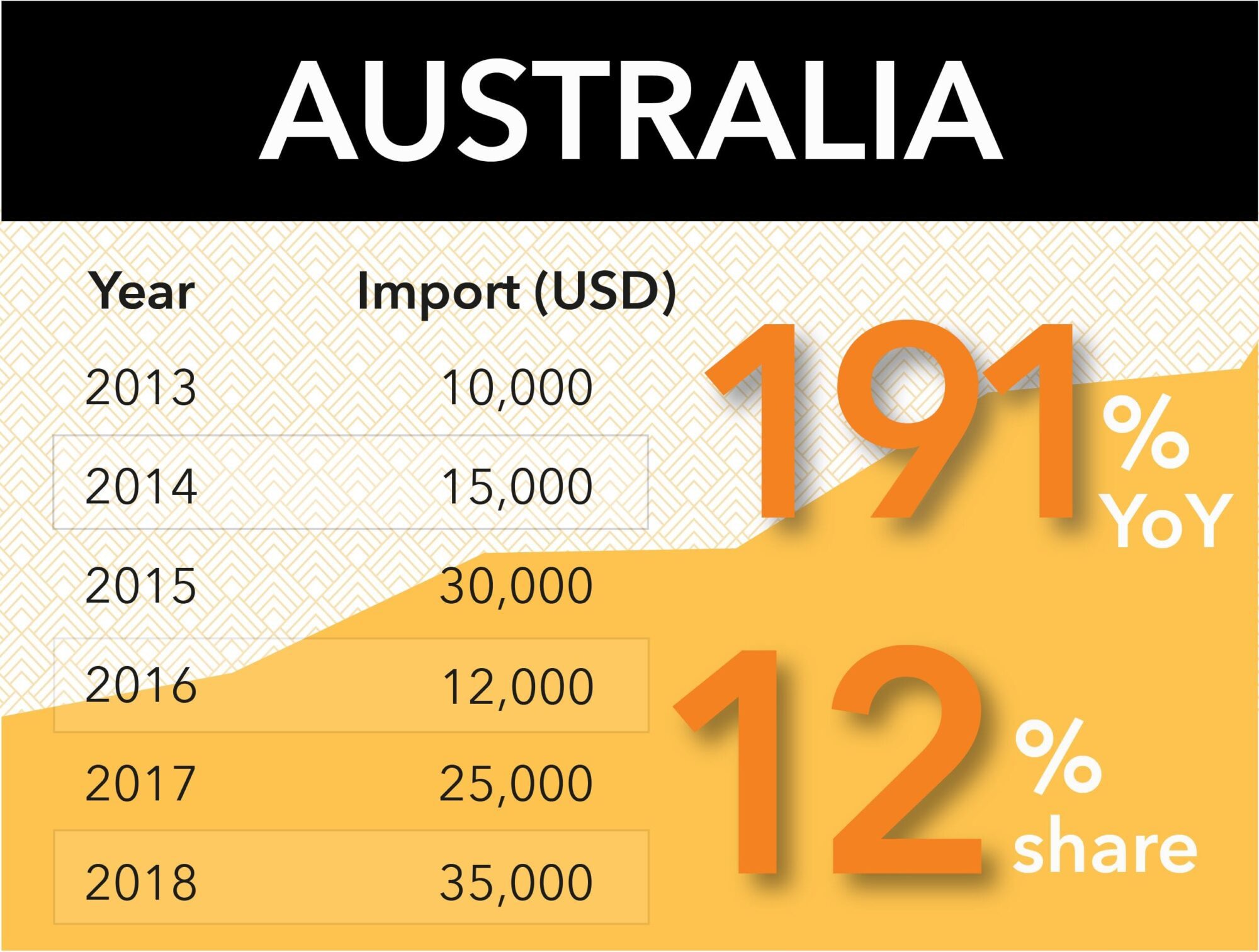

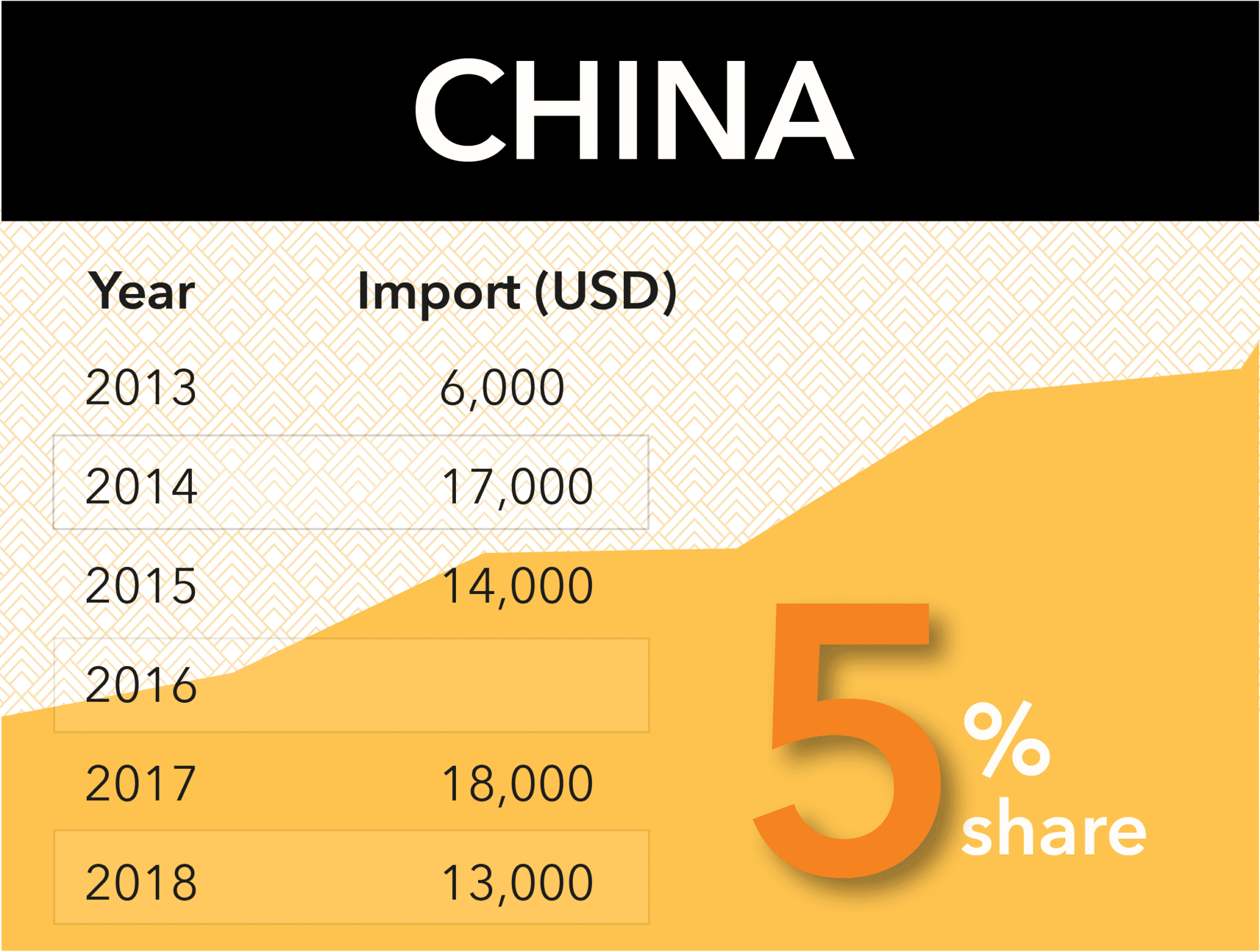

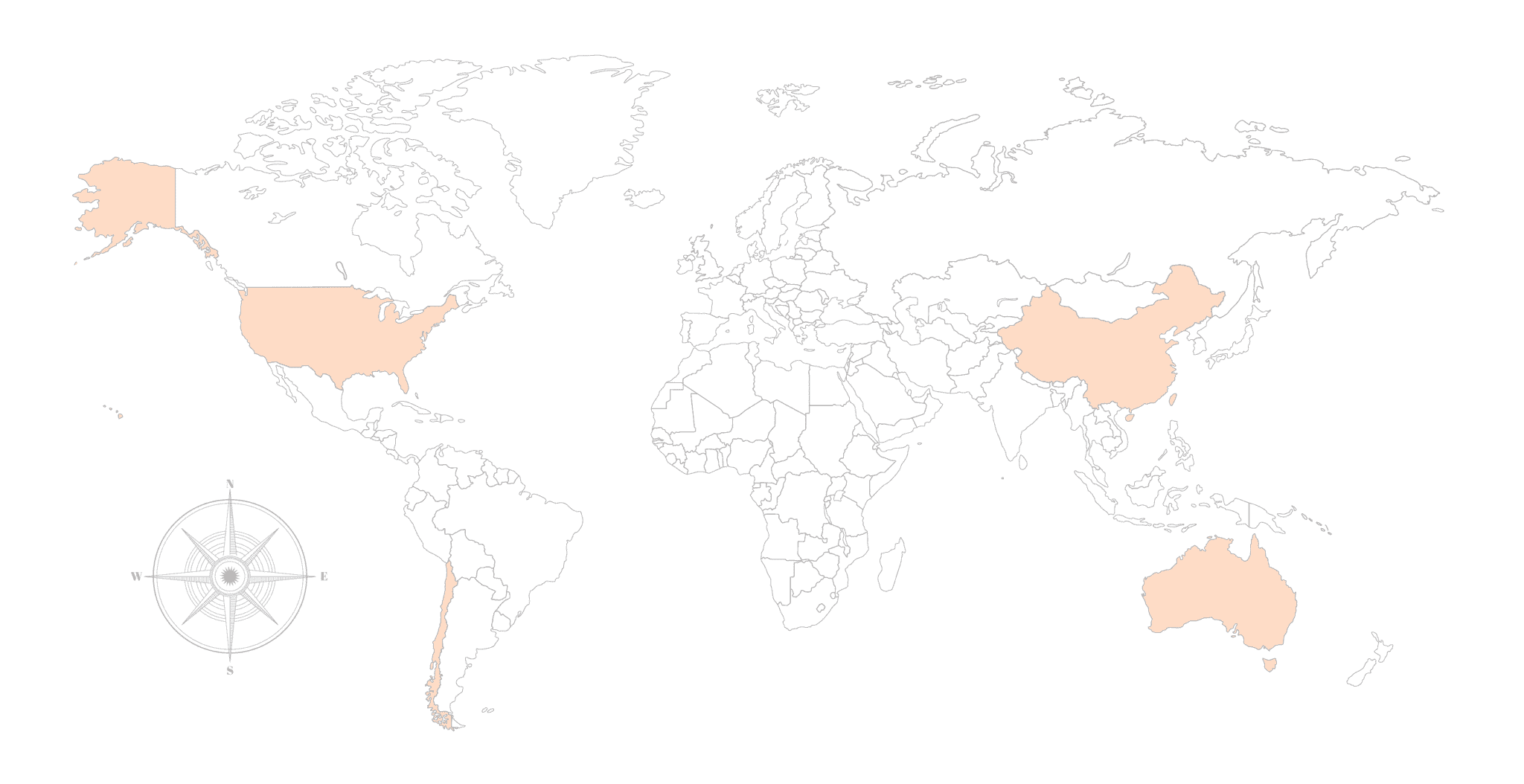

Top 5 countries that imported

Sri Lankan coffee from 2013-2018

Opportunities for arabica coffee

Sri Lanka

is ripe with opportunities and reasons to expand the domestic specialty coffee industry.

BETTER AROMA

INTERNATIONAL INTEREST

NICHE MARKETS

CLIMATE

Nearly 80% of specialty coffee produced in Sri Lanka originates from smallholder farmers and backyard farmers, who are mostly women.

MDF Interventions

MDF is working with businesses to move into a cherry-purchasing business model versus the traditional green bean model. The market intervention allows farmers – many of whom are women – to sell high-quality coffee cherries, earning better income and also saving on the time previously spent on drying the cherries into green bean. In addition, MDF interventions seek to improve processing methods and techniques, and support access to good agricultural practices.

Colombo Coffee Company (CCC)

Colombo Coffee Company (CCC) is the largest local arabica coffee seller to Sri Lanka’s Hotel, Restaurant and Café (HORECA) market and the only front-end barista coffee machinery solutions provider in Sri Lanka. Currently, the company markets its coffee under two brands: the flagship Lavazza brand via franchise imports and the Toscana Ceylon brand, produced from locally-sourced, specialty grade, 100% arabica beans.

Ella Coffee Cooperative (ECC)

Ella Coffee Cooperative (ECC) is a joint venture formed between Soul Coffee (Private) Limited and Amba Estate (Private) Limited. Soul Coffee (Pvt) Ltd was incorporated in 2016 as an arabica coffee roasting and packaging business. The company currently sources green bean from a number of independent wet processing mills and a green coffee trader and has a factory based in Colombo.

Helanta Coffee

Royawin Ceylon International (RCI) emerged as an off-shoot of the Japan Fairtrade Congradulate, a farmer-cooperative-based NGO. RCI’s core business involves business-to-business green bean and roasted coffee sales to the local hotel, restaurant and café (HORECA) market. RCI sells unbranded green bean coffee to their buyers’ individual brands, while the roasted coffee is sold under the Helanta brand to the HORECA sector.